Illinois Department Of Revenue Gambling Winnings

- Illinois Department Of Revenue Gambling Winnings Rules

- Illinois Department Of Revenue Gambling Winnings 2019

- Illinois Department Of Revenue Gambling Winnings For Real

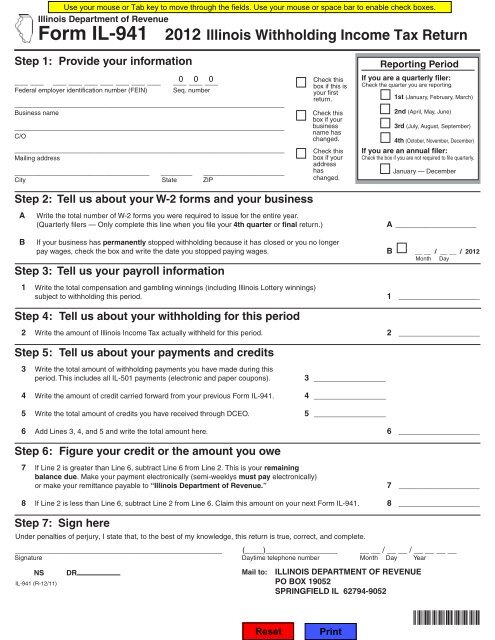

Illinois Gambling and Lottery Laws Lotteries, casinos, race tracks, and other games of chance often are proposed as ways to raise tax revenue for the state, with varying results. Illinois runs a statewide lottery and also allows floating casinos (typically on riverboats) and horse racing venues. Illinois Department of Revenue IL-5754 Statement by Person Receiving Gambling Winnings IL-5754 (R-12/00) Note: Give your completed and signed form to the person who pays you the winnings. Who must complete this form? You must complete Form IL-5754 if you receive payment of Illinois lottery or gambling winnings over $1,000. Search for tax liens filed by the Illinois Department of Revenue. IL-5754 Statement by Person Receiving Gambling Winnings: https://www2.illinois.gov. Illinois Department of Revenue and Illinois Gaming Board officials are still poring over the new 861-page bill to try to understand its effects on the state's financial and gambling landscape.

Congratulations! Let’s walk through how to claim your winnings. Start by selecting one of the options below, based on the amount you won.

For Prizes Up To $600

Most Illinois Lottery retailers will cash winning tickets that are up to $600. Their ability to cash winning tickets is subject to fund availability and the individual retailer’s preference. These prizes may also be claimed by mail.

Prizes Over $600, Including Prizes of $1 Million and Above

Although four Claims Centers are open by appointment only, we encourage winners to claim their prizes via mail. For those interested in booking an appointment at a Claim Center, please see below.

Follow these steps to claim your win by mail:

Print and fill out the claim form and winner questionnaire, which are both available in the claim packet here.

Sign the back of your ticket, make a copy of both sides, and make a copy of your completed claim form and winner’s questionnaire

If you played and won online, you don’t need to print your ticket or receipt. Simply note the game, amount, and that you won online on the form. Also, be sure your name on the form matches the name on your online Illinois Lottery account.

Place ticket/form in an envelope addressed to:

Illinois Lottery Claims Department

P.O. Box 19080

Springfield, Illinois 62794-9912

Mail-in claim via USPS with return address via registered mail.

Illinois Department Of Revenue Gambling Winnings Rules

If you have any questions about mailing your claim, email the Illinois Lottery Claims Department at LOT.Claims@illinois.gov.

If you’ve won over $1 million please call the Illinois Lottery Claims Department at (217) 524-5147 immediately!

Schedule an Appointment

Due to the high volume of claims that require processing and to keep everyone as healthy and safe as possible, claiming your prize at a Claim Center will be by appointment only. To set up your appointment, please select a Claim Center location, date, and time from the available time slots on that day.

You Won? You Won!

Congratulations! Let’s walk through how to claim your winnings. Start by selecting one of the options below based on the amount you won.

Illinois Lottery Extends Prize Claim Period for Lottery Prizes

The Illinois Lottery has extended the timeframe in which winners can claim prizes during the COVID-19 crisis. For players with prizes that were set to expire between now and July 31, 2020, the Lottery is extending the time allowed for players to claim those winning tickets through July 31, 2020.

For instant ticket game expiration dates please see https://www.illinoislottery.com/about-the-games/game-expiration-dates

To check draw-based game results by date, please see https://www.illinoislottery.com/results-hub.

Players with questions can contact the Player Hotline at 1-800-252-1775 or support@illinoislottery.com.

For Prizes Up To $600

Although most local lottery retailers will cash winning tickets that are up to $600. Their ability to cash winning tickets is subject to fund availability and the individual retailer’s preference.

You can also cash lower denomination winning lottery tickets (up to $600) at any of the Prize Claim Centers around the state. Note: the JRTC claim center is currently closed.

We encourage players to mail your winning ticket along with a completed claim form to the Illinois Lottery Claims Department. See instructions of how to mail in a prize claim.

Prizes Over $600, Including Prizes of $1 Million and Above

When you visit a prize center for any prize over $600, you need a photo ID and your social security card or an official document containing your social security number. For information on current claim center process see Updates from the Illinois Lottery.

Due to our claim centers being closed, we are asking winners to claim prizes via mail. Follow these steps to claim your win:

For prizes greater than $25,000, you may select to have your winnings directly deposited into your bank account. If you choose this option, you must complete and submit the original direct deposit form, along with a voided check, in person to a prize claim center or by mail to the following address:

Illinois Lottery Claims Department

P.O. Box 19080

Springfield, Illinois 62794-9912

If you have any questions on mailing your claim, email the Illinois Lottery Claims Department at LOT.Claims@illinois.gov.

If you won over $1 million please call the Illinois Lottery Claims Department at (217)-524-5147 immediately!

Prizes Won Online

When you play online, winnings under $600 are automatically added to your account.

Winnings over $600 need to be processed by the Illinois Lottery Claims department either in person at one of our claim centers or by mail. See instructions of how to mail in a prize claim below.

Claim prize via mail

If you would like to mail in your claim instead of visiting a prize claim center. Follow these steps to claim your win by mail:

Sign the back of your ticket

Print and fill out a claim form and winner questionnaire

Make and keep a copy of your ticket and claim form

Place the original ticket, claim form and winner questionnaire in an envelope

Include your return address on the envelope

Address the envelope to:

Illinois Lottery Claims Department

P.O. Box 19080

Springfield, Illinois 62794-9912

Mail your claim via registered mail

NOTE: If the button above does not work please copy/paste the URL below into your browser:

In order to successfully claim your prize, we ask players to follow these guidelines on the day of their appointment:

- Bring a mask and wear it at all times in the Claim Center.

- Bring a completed claim form and winner questionnaire, found in a single downloadbale packet here.

- Bring a photo ID and proof of Social Security number. Acceptable documents include: Social Security card, federal or state tax return, W-2 or W-2G tax statement, etc.

- Sign your winning ticket and bring it with you.

- Please come to the Claim Center alone, unless assistance is needed.

No walk-ins will be accepted.

Claims FAQ

What happens if I have multiple tickets to claim?

Congratulations on your winning streak! You may redeem multiple tickets in a single Claim Center appointment. Please fill out a claim form for each winning ticket, and make your Claim Center appointment above.

Can I collect my prize via direct deposit?

For prizes greater than $25,000, you may select to have your winnings directly deposited into your bank account. If you choose this option, you must complete and submit the original direct deposit form, along with a voided check, in-person to a prize Claim Center or by mail to the following address:

Illinois Lottery Claims Department

P.O. Box 19080

Springfield, Illinois 62794-9912

What do I need to bring to the claim center?

When you come to the Claim Center, make sure you bring the following:

A mask and wear it at all times in the Claim Center.

Bring a completed claim form and winner questionnaire.

- A Photo ID

- Bring proof of SSN (any one of the acceptable items listed below).

- Social Security card

- W-2or W-2G

- 1099 form

- Paystub (with your name and full Social Security number on it).

- Social Security Administration documents

- Federal or State tax return

Signed winning ticket

What happens if I won online?

When you play online, winnings under $600 are automatically added to your account.

Winnings over $600 must be processed either in person at one of our Claim Centers or by mail. See instructions on how to mail in a prize claim above.

Winner's HandBook

View the Illinois Lottery Winner's Handbook.

Frequently Asked Questions

View the Winning FAQs for more information.

Prize Claim Center Locations

Reminder! When you visit a claim center to file a claim for any prize amount over $600, you need to bring a photo ID, AND your Social Security Card or some acceptable means of verifying your Social Security Number.

CHICAGO James R. Thompson Center | DES PLAINES Regional Office 1, 2, & 6 | ROCKFORD Regional Office 3 |

FAIRVIEW HEIGHTS Illinois Lottery, Region 4 | SPRINGFIELD Regional Office 5 & Lottery Central Prize Center Region 5 Telephone: 217/321-4751 Lottery Central/Player Hotline |

| Holiday | 2020 |

| New Year's Day | Wednesday, January 1 |

| Martin Luther King Day | Monday, January 20 |

| Lincoln's Birthday | Wednesday, February 12 |

| President's Day | Monday, February 17 |

| Memorial Day | Monday, May 25 |

| Independence Day | Friday, July 3 (Observed) |

| Labor Day | Monday, September 7 |

| Columbus Day | Monday, October 12 |

| General Election Day | Tuesday, November 3 |

| Veteran's Day | Wednesday, November 11 |

| Thanksgiving | Thursday and Friday, November 26 and 27 |

| Christmas | Friday, December 25 |

Illinois Department Of Revenue Gambling Winnings 2019

What Play Makes Possible

By law, profits from all regular Lottery games are deposited into the state's Common School Fund, supporting kindergarten through 12th grade public education. Illinois students and schoolrooms receive nearly $731 million per year in Lottery revenue - about 9.6% of the state's annual contribution to K-12 education. (That's a lot of chalk).

The Illinois Lottery is additionally mandated to conduct Lottery games that benefit specific causes. The lottery supports the Carolyn Adams Ticket for the Cure, the Illinois Veterans Assistance Fund, Red Ribbon Cash (HIV/AIDS Prevention), MS Mission Move (supports Multiple Sclerosis Research), and Special Olympics. Learn more about the specific causes Illinois Lottery helps.

A wide array of expanded gambling options would increase gambling revenue by 70% in Illinois after years of relative stagnation, say supporters of the bill that passed during the weekend's overtime legislative session.

'Within the next six years, this is expected to generate an additional $1 billion a year,' said state Sen. Terry Link of Indian Creek, a longtime backer of gambling growth.

But some government finance watchdogs are skeptical.

'This historic expansion of gambling received very limited vetting, and when considered in the context of past underperformance of such revenues, raises real questions about whether projected revenues will pan out,' said Laurence Msall, president of the nonpartisan government research organization the Civic Federation.

Gambling revenue has fallen short of estimates in the past. For instance, the state had hoped privatizing the Illinois Lottery in 2010 would increase revenue, but the extra money never materialized and the state terminated a partnership with Northstar Lottery Group in 2015 due to 'poor performance,' according to an Illinois Commission of Government Forecasting and Accountability report.

Estimates for video gambling revenue also fell short of initial goals because some towns were slow to welcome it or never did allow it at all, including Chicago.

The commission originally estimated $345 million to $641 million in annual revenue from video gambling. Actual revenue hit $347 million in 2018, five years after the first terminals were installed.

Illinois Department of Revenue and Illinois Gaming Board officials are still poring over the new 861-page bill to try to understand its effects on the state's financial and gambling landscape. Neither agency has released any statement regarding the changes and directed inquiries about it to the legislature.

Last year the state reported nearly $1.4 billion in gambling revenue from lottery sales, horse racing, casinos and video gambling. That's up 3.5% from 2017 but is less than what the state pulled in at its high water mark in 2006, when there was no video gambling and one fewer casino in the state.

The bill passed Sunday bill allows for sports betting, puts three more casinos in the Chicago area, grants slot machines for both O'Hare and Midway airports, adds slots and table games to horse-racing tracks like Arlington Park, and increases the number of video gambling machines allowed at bars and restaurants. A number of other nuanced changes to the state's gambling laws are expected to increase revenue for the state as well.

Arguably the biggest change to the state's gambling laws is allowing sports betting at casinos, horse-racing tracks and larger sporting venues with major league teams or professional car races. That means the United Center, Soldier Field, Wrigley Field, Guaranteed Rate Park, Chicagoland Speedway and World Wide Technology Raceway near St. Louis would all be eligible to open sportsbooks.

The initial cost of a license is $10 million, with renewal every four years for $1 million. The state would also take 15% of revenue collected after winnings paid to wagerers. That rate is 17% for sportsbooks in Cook County, with the extra 2% going toward Cook County circuit court, state's attorney and public defender costs, said a spokesman for Cook County President Toni Preckwinkle.

Sports betting licenses for casinos and horse-race tracks would not exceed $10 million, but they could be lower depending on the size of the operation, according to the bill. The state would also issue sports betting licenses for three online operators, but those licenses would cost $20 million and would be selected from qualifying candidates by the state gaming board.

The additional three casinos authorized in the bill would be in Waukegan, Chicago and an as yet undetermined South suburb in Cook County. The legislation would allow the casinos to have 1,600 betting positions, up 400 from the state's current maximum. It would allow current casinos to increase their positions to as many as 2,000.

The bill also would allow video gambling operators to increase the number of terminals in a location to six from five, but the state would take an additional 3% cut. Another 1% would be added to the state share next year, according to the bill.

Illinois Department Of Revenue Gambling Winnings For Real

The state currently receives 25% of video gambling revenue from each terminal.